May 28, 2025

March 29, 2025

Handling Leases When Selling a Business

By Anthony Rigney, CBI When preparing to sell a business, one of the most important—but often overlooked—components is the lease agreement. After all, the majority of small businesses lease rather than own their premises. 📊 In fact, according to the U.S. Small Business Administration, roughly 60%* of small businesses lease their commercial space. If your business falls into this category,...

February 28, 2025

What I Do for You as Your Business Broker

What I Do for You as Your Business Broker? Selling a business is far more complex than selling real estate or other assets. It requires confidentiality, financial analysis, marketing, buyer qualification, negotiation, due diligence, and deal structuring—all while you continue to run your business. With 18 years of experience, I have personally closed over 200 business transactions. I am: ✅...

February 17, 2025

What Do Business Brokers Charge for Commissions?

What Do Business Brokers Charge for Commissions? Understanding Business Broker Commissions If you’re planning to sell your business, you may be wondering: What do business brokers charge for commissions? This is a crucial question because broker fees directly impact your net proceeds from the sale. While there are common industry standards, business brokers set their fees independently, and commission rates...

January 16, 2025

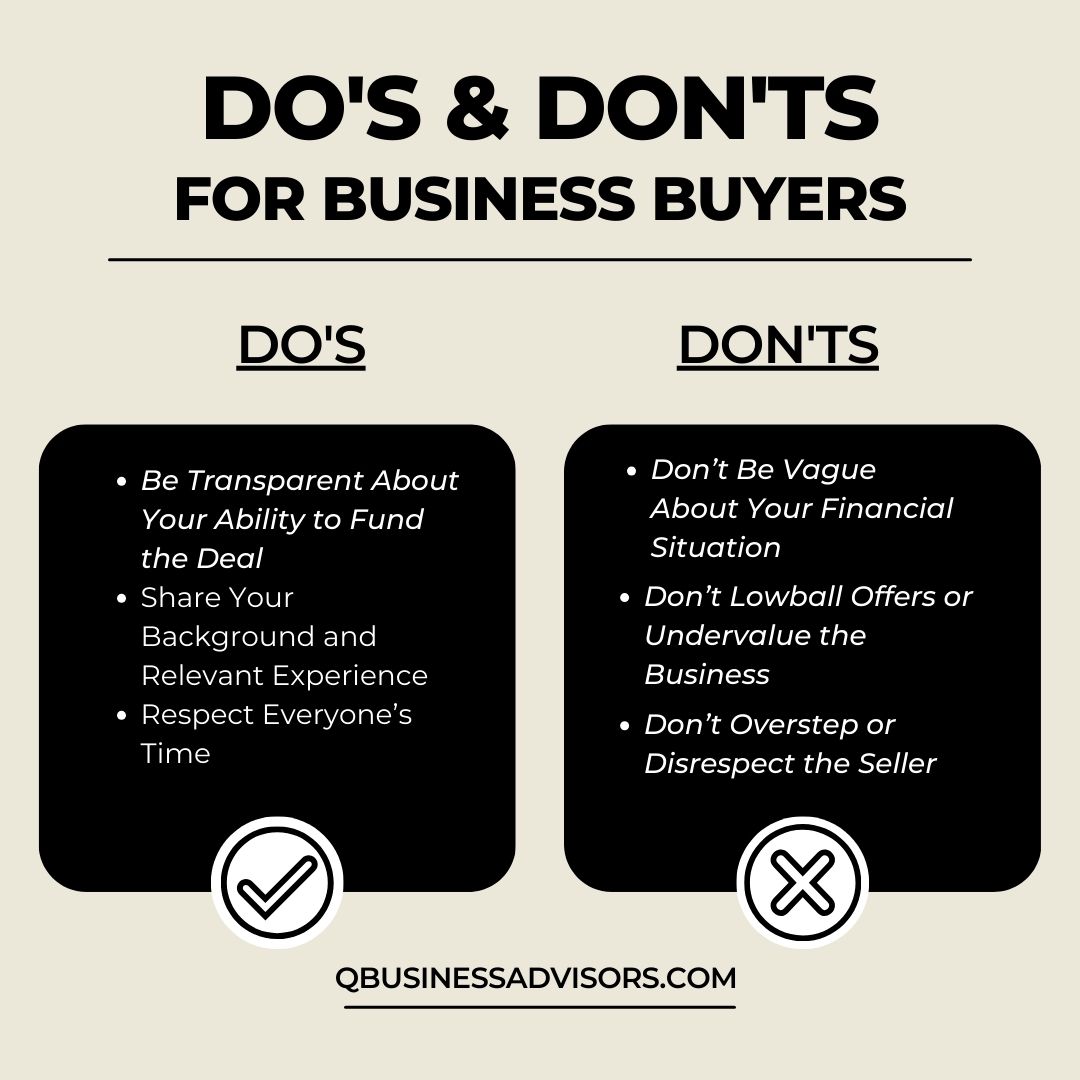

How to get a Business Broker to take you seriously

Do’s: Share Your Funding Plan Be open about how you plan to finance the purchase. Whether it’s an SBA loan or personal funds, providing details and documentation builds trust. If someone else is helping with funding, involve them early and ensure they’re ready to sign any required agreements. Highlight Your Experience Share a little about your professional background and skills...

January 1, 2025

Sell your Business in 2025! Thousands of Buyers. Proven Results.

18 Years of Experience. Thousands of Buyers. Proven Results. As we enter 2025, it’s shaping up to be a banner year for business sales, and my team and I at Quorum Business Advisors are eager to help you seize the moment. With 18 years of experience in the industry, I’ve developed a reputation not just for honesty and integrity, but...

December 24, 2024

Predicting the Hottest Selling Businesses in 2025

As we approach 2025, the dynamics of business sales are poised for significant shifts influenced by economic trends, policy changes, and consumer behavior. Based on current observations and market analysis, here are some predictions for industries that are likely to experience strong interest from buyers in the coming year. Domestic Manufacturing Domestic manufacturing is expected to be one of the...

December 6, 2024

Business Brokerage Market in 2025: Poised for a Bumper Year

The Main Street Business Brokerage Market in 2025: Poised for a Bumper Year The Main Street business brokerage market is set for a dynamic year in 2025, driven by favorable economic conditions, shifting investor strategies, and a demographic wave of retiring business owners. This convergence of factors suggests that 2025 could be one of the most active years for business...

October 31, 2024

Business Owners: Do You Take Vacations?

Business Owners: Are You Able to Take a Vacation? If you’re a small business owner, you know that taking time off can be a challenge. Can you fully disconnect from your work, perhaps for a two-week cruise, or do you find yourself only able to manage a day or two here and there? Or maybe you feel so tied to...

September 27, 2024

Unlocking the Potential of Your Retirement Funds to Buy a Business

Unlocking the Potential of Your Retirement Funds to Buy a Business: Understanding ROBS Many aspiring business buyers don’t realize that they can use their retirement savings to fund a business purchase through a Rollover as Business Startup (ROBS) arrangement. This self-funding option allows buyers to invest their retirement funds into their new business without incurring early withdrawal penalties or taxes....

September 27, 2024

Why You Should Always Be Preparing Your Business for Sale

Why You Should Always Be Preparing Your Business for Sale – Even if You Don’t Plan to Sell Many business owners don’t think about selling until it’s necessary or until they’re ready to move on. But in reality, preparing your business for sale is something you should always be working on—whether or not you plan to sell in the near...

September 26, 2024

How to Value My Business for Sale

How to Value My Business for Sale: A Practical Guide to Setting the Right Price One of the most challenging aspects of selling a business is determining its value. Setting the right price is crucial for attracting buyers and maximizing your return. Here’s how to value your business for sale. 1. Understand the Different Valuation Methods There are several ways...

September 26, 2024

Steps to Selling a Business

Steps to Selling a Business: A Comprehensive Guide for Business Owners Selling a business can seem overwhelming, but breaking the process into manageable steps can make it much easier. Here’s a short guide to the key steps involved in selling a business. 1. Prepare for the Sale Preparation is key. The first step will be to obtain professional guidance. The...

September 26, 2024

Business Brokers Near Me

How to Find the Right Professional for Your Business Sale If you’re searching for “business brokers near me,” it’s likely because you’re considering selling your business and need expert guidance. Finding the right business broker is a critical step in achieving a successful sale. Here’s how to find the perfect match. Understand What a Business Broker Does A business broker...

September 26, 2024

Best Way to Sell a Business

The Best Way to Sell a Business: Tips for a Successful Exit There are many ways to sell a business, but not all are equally effective. Finding the best way to sell your business depends on your goals, timeline, and the current market environment. Here are the best strategies to ensure a smooth and profitable exit. Work with a Business...

September 26, 2024

How to Sell My Business

How to Sell My Business: A Step-by-Step Guide to Maximizing Value Selling your business is one of the most significant financial decisions you’ll make. Whether you’re looking to retire, explore new opportunities, or cash in on years of hard work, knowing how and when to sell your business is of critical importance. This guide will walk you through the process,...

June 5, 2024

Business Broker Licensing – What you need to know

In todays world of buying and selling businesses, the role of a business broker is crucial. Business brokers act as intermediaries, helping buyers and sellers navigate the often complex process of a business transactions. However, the requirements for business brokers vary significantly from state to state, with some states mandating specific licensing while others do not. This disparity can lead...

May 16, 2024

Top Ten Selling Businesses in Florida

A Comprehensive Overview Restaurants: Topping the list, the restaurant industry in Florida has seen a significant number of transactions. This category is diverse, encompassing full-service and breakfast and lunch cafes, coffee shops, take-out establishments, bagel stores, fast casual eateries, as well as specialized outlets such as pizza, ice cream stores, frozen yogurt shops, and smoothie bars. The diversity and constant demand...

February 22, 2024

Florida’s Unique Business for Sale Marketplace

Navigating the Business Market in Florida: Florida’s booming economy and diverse business landscape make it a hotbed for entrepreneurs looking to buy a business. What sets Florida apart is not just its vibrant economy or the wide variety of opportunities available but also the unique structure it offers for business buyers through the Business Brokers of Florida (BBF). With over...

February 13, 2024

Understanding Small Business Pricing

In the world of small business transactions, understanding the methodology behind business valuation and pricing is crucial for both buyers and sellers. Central to this process is the standard, yet often misunderstood assumption: small businesses are evaluated as if they will be run by an owner-operator. This principle is fundamental, not only for ensuring a standardized comparison between different businesses...

January 26, 2024

The Critical Role of Business Brokers in the Modern Economy

In the complex nature of the modern economy, certain key players operate discreetly, their significance often overshadowed by their commitment to confidentiality and the niche nature of their business. Among these yet underappreciated figures are the professionals in the business brokerage industry*. While our presence might not dominate headlines, our role is nonetheless fundamental, acting as the silent guardians of...

January 23, 2024

We are hiring for the position of Business Broker

Job Description Your major responsibilities will include: •Developing and securing new “business for sale” listings through networking, direct marketing and calling on business owners using a consultative selling approach •Preparing business valuations, financial recasting and marketing packages for your listings •Qualifying, developing and coaching new business buyers •Handling transaction management: working with sellers, buyers, accountants, attorneys, landlords and all related...

January 10, 2024

Funding the Purchase of a small business

For those interested in buying a business, one of the most critical steps is securing the funding. Understanding your financing options is key to a smooth process. Here are some of the best avenues to explore: Self-Funding: If you have the cash to purchase a business in full this can make you a very attractive prospective buyer. Sellers may be...

January 4, 2024

Will 2024 be the year you buy a business?

Let me help you make your dreams come true in 2024. As one of Florida’s top Business Brokers I can help you find the right business. There are four things you should know about my services. One Broker As a member of the Business Brokers of Florida I cooperated with over 1,100 active business brokers in this State. That means...

January 2, 2024

Will 2024 be the year you sell your business?

Will 2024 be the year you sell your business? A guide for business owners reaching retirement age. As we step into 2024, many of the baby boomer generation are reaching the age of retirement. This period often brings a significant decision to the fore: what to do with your business? For many of you, your business isn’t just a career;...

December 28, 2023

An open letter to business owners

Dear Business Owner, As a dedicated entrepreneur, you have nurtured your business with hard work and vision. Now, it may be time to consider the next big step for your company and yourself. I am Anthony John Rigney, a professional business broker with extensive experience in assisting businesses like yours in achieving their strategic goals. Achieve the Best Price in...

December 22, 2023

A Message for Business Owners Looking to Sell

As a seasoned business broker, my approach involves a meticulous analysis of each business through the eyes of a potential buyer. This perspective is crucial, especially when preparing a business for sale. It’s about conducting a thorough, critical examination of the business, highlighting its strengths while equally acknowledging its weaknesses. Buyers are typically attracted to aspects like consistent profitability, scalability,...

November 29, 2023

Understanding the handling of prepaid items in a business acquisition

Understanding the handling of prepaid items in a business acquisition When a business changes hands, it is important to address the handling of prepaid items such as gift cards and coupons as these items represent a future liability for the buyer. Prepaid items such as gift cards, coupons, and similar commitments represent both a business asset and a liability. Many...

November 27, 2023

How to effectively inquire on Business for Sale listings

Business Buyer Tips: Navigating the Process of Inquiring on Listings When venturing into the world of business acquisitions, it’s crucial to approach the process with professionalism and tact. Understanding the nuances of inquiring about business listings is key to establishing yourself as a serious buyer and facilitating a smooth transaction. Here are some essential tips for prospective business buyers: Expect...

November 22, 2023

Buying a Business with No Money Down

There’s a common misconception, sometimes fueled by misleading advice, that purchasing a business with 100% seller financing, or with a minimal down payment such as 10%, is a feasible option. However, this scenario is rare and, frankly, can be perceived as a lack of respect towards business owners. To understand why such arrangements are uncommon, it’s crucial to look at...

November 15, 2023

Bridging the Gap

Understanding the Diverse Worlds of Main Street Acquisitions and Private Equity In the ever-evolving landscape of business acquisitions, a new trend is emerging. Private equity firms and private investors, traditionally focused on high-end, large-scale investments, are now venturing into Main Street acquisitions. This shift, while promising, brings with it a clash of cultures and expectations. As these two worlds collide,...

November 14, 2023

The Risks of Overvaluing Your Business: Insights from a Broker

In the competitive world of business sales, owners often face a harsh reality when it comes to the valuation of their businesses. As a seasoned business broker, I frequently encounter business owners who are disappointed by our valuation. This discrepancy between reality and expectations leads some to believe that by shopping around for a broker who will appraise their...

November 7, 2023

Smart Negotiation Strategies When Buying a Business

Title: Smart Negotiation Strategies When Buying a Business When stepping into the world of business acquisitions, the negotiation table is where futures are determined. It’s not just a transaction but a pivotal moment that can either forge successful partnerships or leave parties walking away disappointed. Let’s dive into the art of negotiating the purchase of a business—what to do and...

October 25, 2023

Top Ten Selling Businesses in Florida

Subject: Top Ten Selling Businesses in Florida: A Comprehensive Overview In the ever-evolving business landscape of Florida, certain industries have demonstrated remarkable resilience and growth, capturing the attention of buyers and investors alike. Utilizing data from the business broker database for the state of Florida, we have compiled a list of the top ten selling businesses from January 1, 2022,...

September 25, 2023

Preparing your business to sell

Preparing a business for sale is a significant undertaking that should not be taken lightly. Its best to ready yourself and the business in advance. In this article Anthony John Rigney of Quorum Business Advisors gives Important insight into some of the key aspects of preparation. Financial: Ensure that your financial documents are up to date. Tax returns must...

September 18, 2023

Understanding the E-2 Visa program

The “E-2 Investment Visa” program is little understood and there are many misconceptions. In the following article I attempt to clarify what this program is and how we as business brokers are uniquely qualified to offer assistance. The E-2 visa is an investment based nonimmigrant visa, which allows citizens of certain Countries to live and work in the USA by...

July 31, 2023

What Not To Do – When Buying a Business

High Pricing Perceptions Some businesses may be overpriced. However, quickly judging an appropriately or even aggressively priced business as overpriced will signal to the Broker that you do not have serious intent. In fact, serious buyers seldom overtly express such views, even when they feel a business is overpriced. Refusal to Share Information If you are interested in a business,...

July 25, 2023

12 Frequently Asked Questions When Selling Your Business.

What does a business broker do? A business broker is a professional who assists in the buying and selling of businesses. We help business owners accurately value their business, identify potential buyers, oversee negotiations, and guide the business through the transaction process. We function as a buffer between the buyer and the seller, facilitating communication and ensuring the transaction goes...

May 15, 2023

Mistakes to avoid when buying a business

The 5 most common mistakes buyers make when buying a business Not Seeking Professional Help: One of the biggest mistakes buyers make is not seeking professional help. Buying a business is a complex process that involves many legal, financial, and operational aspects. A business broker can guide you through this process, help you find businesses that match your interests and...

May 1, 2023

When Insider Business Deals Go South:

When Insider Business Deals Go South: The Challenges of Selling to Employees or Family Members Introduction As a business broker, I’ve seen countless small business owners looking to sell their businesses to employees or family members, and understandably so. These inside buyers often possess a deep understanding of the business, its processes, and its culture. However, the majority of these...

April 26, 2023

Tax Implications of Selling a Business

As a Business Broker, I am often asked by business owners about the tax consequences of selling a business. I will usually refer them to their CPA or tax professional. However, because this is something I often deal with, I have written the following article. My goal is to help owners better understand the tax implications of selling a small...

April 13, 2023

Should you sell your Business or wait?

Owning a business can be a fulfilling and lucrative endeavor, but at some point, every business owner will face the decision of whether or not to sell their company. From a financial perspective, selling a business may not always make sense, as the potential for continued profits could outweigh the immediate payout. Businesses are typically valued using multiples of earnings....

April 10, 2023

Advice for Young Business Owners

Here are a few pieces of advice that may be helpful for new business owners: Start with a solid business plan: Before starting your business, take the time to create a comprehensive business plan. This will help you identify your target market, competition, financial projections, and other key details that will be essential for the success of your business. Focus...

April 5, 2023

The 9 Key Traits of Successful Entrepreneurs

Passion and drive: Successful entrepreneurs are passionate about their work and have a burning desire to achieve their goals. They have a strong work ethic and are willing to put in the time and effort required to make their vision a reality. Resilience: Entrepreneurship can be a challenging and unpredictable journey, and successful entrepreneurs must be able to bounce back...

March 27, 2023

Selling Your Business – Documents you will need

What Documents Will Prospective Buyers Want to See When selling your business, it is best to prepare in advance for the documentation a buyer is likely to require during due diligence. The list below is a good guide but is not intended to be fully inclusive. No two deals are the same but you can use this as a starting...

March 14, 2023

Ten Attributes of an Entrepreneur

The key attributes of a successful entrepreneur include: Passion: Successful entrepreneurs have a burning passion for what they do. They believe in their idea and are willing to work tirelessly to make it a reality. Resilience: Entrepreneurship is a journey full of ups and downs, and successful entrepreneurs have the resilience to bounce back from failures, setbacks, and challenges. Vision:...

March 13, 2023

Restaurant Industry Best Days Yet to Come?

The restaurant industry was significantly impacted by the COVID-19 pandemic, with many restaurants closing their doors temporarily or permanently due to government mandates, reduced demand, and financial strain. However, as life has largely returned to normal, the industry has seen a significant rebound. According to the National Restaurant Association, restaurant sales hit an impressive $95.5 billion in January of 2023....

February 9, 2023

The one question you should never ask the seller of a business.

Over my sixteen years in the Business Brokerage Industry I have sat in on many buyer/seller meetings. The initial meeting between parties is often what determines if a deal will happen or not. I watch carefully to see the chemistry between buyer and seller. If both parties are comfortable and at ease with each other there is a good chance...

January 24, 2023

We Are Hiring

Position: Business Broker Quorum Business Advisors- Florida Job Description Your major responsibilities will include: •Developing and securing new “business for sale” listings through networking, direct marketing and calling on business owners using a consultative selling approach •Preparing business valuations, financial recasting and marketing packages for your listings •Qualifying, developing and coaching new business buyers •Handling transaction management: working with...

January 5, 2023

Will 2023 be the Year you sell your Business

January is a time of the year when people consider making big changes in their life. For some this means joining a gym. For others the decision that this New Year will be the one when they retire from work. For small business owners the added complication is the need to find someone to take over their Company. This is...

December 16, 2022

The five worst mistakes you can make as a business owner

As a Business Broker I have analyzed hundreds of small businesses and these are the five most common mistakes I see their owners make. You are the business Being too involved in the mundane work of the business is a common mistake of the small business owners. A Restaurant owner washing dishes or flipping burgers. A convenience store owner behind...

December 15, 2022

Kitchen and Bath Contractor – Under Contract

From listed to under contract in less than eight weeks. We had two of our listings go under contract in the same day. We are running low on inventory and need more businesses to sell. If you would like to explore selling your business, contact us at Quorum Business Advisors today. Our initial consultation is free and always confidential....

December 15, 2022

Property Management Business – Under Contract

Property Management Company From listed to under contract in less than six weeks. Agreed price above list price and to close in 30 days. If you would like to explore selling your business, contact us at Quorum Business Advisors today. Our initial consultation is free and always confidential. Our inventory is low and we have more buyers than listings....

September 29, 2022

Selling your Business – Should you tell your employees

While many business owners feel the urge to be “honest” with their employees, especially the key ones. This is often a misguided impulse. Telling your employees early in the process only creates unnecessary anxiety for them. Even worse it can cause them to panic and seek other employment. Losing key employees prior to the closing of the deal can cause...

July 21, 2022

How much is your Business worth?

For small business owners their business can be their most valuable asset. When it comes time to move on or retire selling the business can provide them with the financial means to do so. But what is a business worth? Well, there are lots of ways to determine that. As a business broker my main interest is in determining what...

July 20, 2022

Working Capital and the Sale of a Business

The simple definition of Working Capital is Current Assets – Current Liabilities. But in real world application it is much tricker and is frequently the source of heated disagreement between buyers and sellers. Working capital is used to fund operations and meet short-term obligations. If a company has enough working capital, it can continue to pay its employees and suppliers...

July 12, 2022

Ten Steps to Buying a Business

Step 1 Before you begin to look for a business take some time to do a serious inventory of your skills, aptitudes and qualifications. Determine how much you have available to invest. Whether or not you will be seeking financing (either SBA or seller) and what your timeline is. Identifying your preferred industries, price range etc. will help you narrow...

July 1, 2022

Jacksonville Best Place to Live

Jacksonville has emerged as one of the fastest growing cities in the country. In fact, Forbes magazine recently cited Jacksonville as the #2 most popular city to move to. Jacksonville has been featured on a list of the best places to live! The U.S. News & World Report published “The 25 Best Places to Live in the U.S. in 2021-2022″...

June 28, 2022

Understanding Seller Discretionary Earnings (SDE)

Seller Discretionary Earnings (SDE) is also sometimes called the “Owners Benefit” and the terms can be used interchangeably. This is a key metric when it comes to valuing, buying and selling small. In this article I discuss how SDE is calculated. When net income or cash flow is calculated we use the Adjusted Net (Owner Benefit) figure. This is the net profit...

June 17, 2022

Sell Your Business in 2022

Let me help you make your dreams come true in 2022. As one of Florida’s top Business Brokers I can help you find the right buyer for your business. There are five things you should know about my services. One Broker As a member of the Business Brokers of Florida (BBF) I cooperate with over 1,100 active business brokers...

June 14, 2022

Buy a Business in 2022

Let me help you make your dreams come true in 2022. As one of Florida’s top Business Brokers I can help you find the right business. There are five things you should know about my services. One Broker As a member of the Business Brokers of Florida I cooperated with over 1,100 active business brokers in this State. That means that...

June 9, 2022

Choosing your Advisors when buying or selling a Business

Choosing your Advisors when buying or selling a business. I have previously addressed the importance of finding the right business broker when selling or buying a business. But what about other advisors? As a Business Broker I am very careful not to offer tax, legal or financial advice. My expertise is in the field of business acquisition. I...

June 8, 2022

Just Published

Just published my first book on Amazon. “Selling Business Insights Vol. 2” I am one of several co-authors. Get your Kindle copy for just 0.99. Click on the link below to get your copy. Business Selling Insights Vol. 2 Anthony John Rigney Owner / Broker Quorum Business Advisors, LLC...

February 22, 2022

Small Business Valuation Multiples Explained

Small Business Multiples Explained. When it comes to misconceptions surrounding the sale of a business, small business valuation multiples may be the most routinely misunderstood – with the most profound consequences. How can one simple number cause so much confusion? What does the multiple say about a business? And is “ten times” considered the norm, pie in the sky, or...

February 2, 2022

5 Mistakes when Selling your Business

5 Mistakes when Selling your Business Every day, all a crossed America, small business owners unintentionally make one or more of the following mistakes, which in turn drastically reduces their business value and or likelihood of successfully selling and exiting from their business. A single mistake or misstep could cost you tens of thousands of dollars in valuation change. People...

January 7, 2022

7 steps to selling a small business

How to Sell Your Small Business Reviewing these seven considerations can help you build a solid plan and make negotiations a success. Reasons for the Sale You’ve decided to sell your business. Why? That’s one of the first questions a potential buyer will ask. Owners commonly sell their businesses for any of the following reasons: Retirement Partnership disputes Illness...

December 10, 2021

How to Sell your Business

How to Sell Your Business Out of all the businesses listed for sale, only about 10% to 20% ever sell. There are many reasons why your business sale may fail to go through. It could be that your business is bleeding cash, you have overpriced it, you have irreconcilable flaws, or you lack a professional business broker. Now, if you’re trying to...

December 8, 2021

Consider a Career with Quorum Business Advisors (Video)

Quorum Business Advisors is hiring Business Brokers throughout the State of Florida. Experience is preferred but not essential. Requirements include. – Florida Real Estate Licenses – Strong work ethic – Ability to understand financial statements For those willing to work hard the sky is the limit in terms of income and job satisfaction. Set yourself on the road to a...

September 28, 2021

Consider a career as a Business Broker (video)

Based in Jacksonville, FL, we welcome approved candidates who have a Florida real estate license to consider a business broker career with our firm Unlimited income potential Requirements: Florida Real Estate License Strong Work Ethic Ability to understand Financial Statements Call today 904.725.7677...

April 29, 2021

Its a great time to sell your business!

Great time to sell your Business. If you have a thriving business now is the time to exit. Inventory is low and prices are up. This Industry report from Bizbuysell. One year after the onset of the pandemic, entrepreneurs continue to flock to high performing businesses causing median sale prices to jump 30% compared to Q1 of 2020, according to...

April 28, 2021

Business Owners? Ready to retire?

Time to retire? Don’t just close your business. Contact us first. We are an experienced Business Broker and we can help you get the best price. Contact us today. Quorum Business Advisors. ...

April 28, 2021

Thinking of buying a business? (Video)

Thinking of buying a business? Watch this short video and then contact Quorum Business Advisors. We can help you. ...

April 27, 2021

Should you own your own Business?

It is the dream of many Americans to wake up as their own boss. Working for someone else can feel like you are running in place. You never know what will change tomorrow. Will you be demoted or out of a job? Will the dream promotion go to someone else? Often control seems out of your hands. And these days...

April 27, 2021

If you are considering selling your business, schedule your free consultation here.

Selling your business – An emotional roller coaster The process of selling a business can be somewhat traumatic. First the excitement as you find a buyer and sign an agreement. A sigh of relief thinking that you are near the end. But next comes the “due diligence” when the buyer has the opportunity to do a full investigation of...

January 13, 2021

Choosing a Business Broker (Video)

Preparing to sell your business? What you should know about choosing a business broker. From Quorum Business Advisors....

January 13, 2021

Selling your Business (Video)

...

January 13, 2021

Business Seller Financing (Video)

...

January 13, 2021

Becoming a Business Owner – Video

...

January 13, 2021

Small Business Exit Planning (Video)

...

January 13, 2021

Buying a Business (Video)

...

January 13, 2021

The Value of your Business (Video)

...

January 13, 2021

Business Buyer Documentation (Video)

...

January 13, 2021

The Best Reasons to Sell your Business (Video)

...

July 17, 2020

Business Broker Profile – Anthony John Rigney

...

June 22, 2020

Things to Consider Before Selling Your Business

[divider height=”70″]...

June 22, 2020

Buying a Business in post Covid 19 era

...

June 22, 2020

Psychology of Buying and Selling a Business

...

June 22, 2020

Hot Tips for Business Buyers (Video)

...

March 26, 2020

Businesses That Will Thrive During Coronavirus

Is this unique environment that we are seeking to navigate, some Industries are better suited than others to survive and thrive? I came up with a list of 8 business categories well situation to maintain or even grow throughout this crisis. Liquor Stores It’s just anecdotal right now but it stands to reason that with people stuck at home. Unable...

March 26, 2020

Small Businesses – Surviving Coronavirus

Small businesses – Surviving COVID19 In 2007 when the great financial crisis hit, I was running a small but successful mortgage company. Things went downhill quickly, and I learned some key lessons that I will never forget. Based on that experience, my knowledge gained from 12 years of interacting with small businesses and my discussions with business owners, lenders and...